If you’ve ever had the experience of your debit card not working in shops, you know how frustrating it can be. Fortunately, there are steps you can take to troubleshoot the issue and get back to making purchases.

For instance, you may need to reactivate your card, transfer funds, reset your PIN, or dispute a fraudulent transaction. With the right approach, you can resolve the issue quickly and efficiently.

In this article, we’ll provide practical tips on what you can do if your debit card isn’t working in shops.

Common Reasons Why Debit Cards Fail in Shops

There are several common reasons why debit cards may fail to work in shops.

Insufficient Funds

One of the most common reasons why debit cards fail to work in shops is due to insufficient funds. To resolve this issue, check your account balance and transfer funds if necessary.

Tip: Consider setting up overdraft protection or linking your debit card to a savings account to avoid overdraft fees. You can also set up alerts from your bank or card issuer to notify you when your balance is low.

Network Connectivity Issues

Poor network connectivity can also cause debit card transactions to fail. To avoid this, try turning on airplane mode and then turning it off again, which can reset your phone’s network connection. Alternatively, try using a different payment method or waiting until you have a better network connection.

Tip

Deactivated Card

If your card has been deactivated, contact your bank or card issuer to determine why and how to reactivate it. This could be due to suspicious activity or an expired card, in which case you may need to request a new one.

There are several common reasons for card deactivation:

- Fraudulent activity: If your bank detects suspicious activity on your account, they may deactivate your card to prevent further fraud.

- Excessive chargebacks: If you dispute too many transactions on your account, your bank may deactivate your card to prevent further chargebacks.

- Expired card: If your card has expired, your bank may deactivate it and issue you a new card.

- Inactivity: If you haven’t used your card in a while, your bank may deactivate it for security reasons.

- Payment default: If you fail to make payments on your credit card, your bank may deactivate your card to prevent further debt.

You can set up alerts for suspicious activity or unusual spending patterns. But it’s a good idea to contact your bank or card issuer if you’re unsure why your card has been deactivated.

Expired Card

If your card has expired, you will need to request a new one from your bank or card issuer. To avoid your card expiring, keep track of the expiration date and request a new card before it expires. You can also set up automatic renewals with your bank or card issuer.

Incorrect PIN

If you’re having trouble with your PIN, try resetting it at an ATM or contact your bank to request a new PIN. Keep your PIN confidential and avoid using easy-to-guess numbers like your birthdate or a sequence of consecutive numbers.

Tip

Holds on the Card

Banks may sometimes place holds on your card due to suspicious activity or unusual spending patterns. If this is the case, contact your bank to have the hold removed. It’s also a good idea to notify your bank of upcoming travel plans to avoid potential holds on your card.

To avoid holds on your card, notify your bank or card issuer of any upcoming travel plans, especially if you’re traveling abroad.

By following these specific tips, you can troubleshoot and resolve the most common reasons why debit cards fail to work in shops, allowing you to make purchases with ease.

What to Do When Your Debit Card Doesn’t Work in a Shop

If your debit card doesn’t work in a shop, there are several steps you can take to resolve the issue:

Check for common issues

Firstly, check for common reasons why your card isn’t working, such as insufficient funds, an expired card, or an incorrect PIN. If any of these issues are present, take appropriate action to resolve them.

Check for card reader issues

If your card isn’t working on a particular payment terminal, it may be due to a problem with the card reader itself. Try using a different terminal or contact the merchant to report the issue.

If the card reader appears to be damaged or malfunctioning, notify the merchant or contact the terminal provider for assistance.

Use online banking

If you have access to online banking, you can check your account balance and transaction history to ensure that your account is in good standing and there are no unusual transactions.

Contact your bank or card issuer

If you can’t identify or resolve the issue on your own, contact your bank or card issuer for assistance. They can provide additional guidance and help you troubleshoot the issue.

When contacting your bank or card issuer for assistance, be prepared to provide details about the issue and any steps you have already taken to resolve it. This can help them better understand the problem and provide more effective guidance.

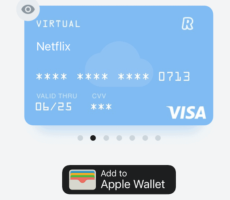

Try using an alternative payment method

If your debit card still doesn’t work, try using an alternative payment method like cash, a credit card, or a mobile wallet. Make sure to carry some cash or an alternative card with you at all times to avoid being caught without a payment option.

Consider using a mobile wallet like Apple Pay or Google Pay, which can provide an added layer of security and convenience.

Report fraudulent activity

If you suspect your card has been compromised or there is fraudulent activity on your account, report it immediately to your bank or card issuer. They can help you block any further unauthorized transactions and issue a new card if necessary.

Change your online banking password immediately and notify your bank or card issuer as soon as possible to help them investigate the issue.

Prepare for future incidents

To avoid future issues, make sure to keep your card up-to-date, your PIN secure, and your account funded. Consider carrying a backup card or using mobile payment options to ensure you always have a payment option.

Keep your card in a secure location and never share your PIN or other sensitive information with anyone.

Tips for Preventing Debit Card Issues in the Future

Here are ten tips for preventing debit card issues in the future:

- Keep your card up-to-date: Make sure to update your card information with your bank or card issuer whenever there is a change of address, phone number, or email.

- Memorize your PIN or store it securely: Avoid writing your PIN down or keeping it in your wallet. Instead, consider using a password manager app or a physical safe to store your PIN securely.

- Monitor your account balance regularly: Check your account balance and transaction history regularly to detect any unauthorized transactions or unusual spending patterns.

- Use secure payment methods for online purchases: Look for secure payment options like PayPal or Visa Checkout when making online purchases. Avoid entering your card information on unfamiliar or unsecure websites.

- Protect your card information: Don’t share your card information with anyone, and be cautious when providing it online or over the phone. Always verify the legitimacy of the merchant or website before entering your card details.

- Notify your bank of travel plans: To avoid holds on your card, notify your bank or card issuer of any upcoming travel plans, especially if you’re traveling abroad.

- Stay informed of security threats and scams: Keep up-to-date with the latest security threats and scams by following reputable sources like the Federal Trade Commission (FTC) or the Better Business Bureau (BBB).

- Avoid making transactions on unfamiliar or unsecure websites: Stick to reputable websites when making online purchases, and look for secure payment options like PayPal or Visa Checkout.

- Don’t share your card information with anyone: Protect your card information by keeping it confidential and never sharing it with anyone, including friends, family, or merchants.

- Use mobile payment options as a backup: Consider using a mobile wallet like Apple Pay or Google Pay as a backup payment option. These apps use additional security measures like biometric authentication to protect your card information.

FAQs

Can I use my debit card online if it’s not working in shops?

Yes, you can still use your debit card for online purchases even if it’s not working in shops, as long as there are sufficient funds in your account and your card hasn’t been deactivated. If there are any issues, you may need to take certain steps to fix them.

Can I use a debit card with a negative balance?

Generally, no, you cannot use a debit card with a negative balance. However, some banks may allow limited overdrafts or offer overdraft protection programs that can help cover small overdrafts.

Why is my debit card working for some stores but not others?

There could be several reasons why your debit card is working for some stores but not others, including differences in payment processing systems or restrictions on certain types of transactions.