Your debit card is an essential tool for accessing your funds, but what happens when it gets damaged?

If your card was damaged, you should assess the damage, contact your bank, and request a replacement if necessary. Protect your card from further damage by storing it in a secure place and avoid using tape to repair it.

Whether it’s a bent, split, or cracked card, it’s important to know what to do to ensure you can still access your money. In this article, we’ll guide you through the steps with practical tips you can take to handle a damaged debit card.

What to Do If Your Debit Card Is Bent or Warped?

If your debit card is bent or warped, it can be frustrating and inconvenient. However, there are a few things you can do to handle the situation:

- Assess the damage. Before you take any action, assess the extent of the damage to your card. If it’s only slightly bent or warped, you may still be able to use it. However, if the damage is more significant, it’s best to get it replaced as soon as possible.

- Contact your bank. If your card is not working or you’re unsure whether it’s safe to use, contact your bank immediately to report the damage and request a replacement. Many banks have 24/7 customer service hotlines, so you can reach them anytime.

- Protect your card. To prevent further damage, store your card in a secure place, such as a wallet or cardholder. Avoid bending or flexing it, and keep it away from heat or liquids.

- Request a replacement. Once you’ve reported the damage to your bank, they will advise you on the next steps to take. Depending on the extent of the damage, they may issue you a new card right away or ask you to come in-person to a branch to get a replacement, which you’ll need to activate.

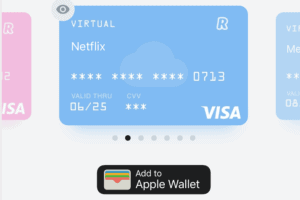

- Use alternative payment methods. While you’re waiting for your replacement card, you can still access your funds using alternative payment methods such as online banking, mobile wallets, or cash.

A bent or warped card can be a frustrating inconvenience, but it’s important to take action to ensure the safety of your funds. By following these practical tips, you can handle the situation quickly and efficiently.

What to Do if the Card Is Split in Half?

If your debit card is split in half, it’s important to contact your bank immediately to report the damage and request a replacement. Using a split card can put your funds at risk, and it’s unlikely to be accepted at merchants or ATMs.

Your bank will advise you on the next steps, which may include visiting a branch to get a new card or having one sent to you by mail. In the meantime, use alternative payment methods to access your funds, such as online banking or mobile wallets.

Using a split card can put someone’s funds at risk because the card’s magnetic stripe or chip may be damaged or missing, making it difficult for ATMs or merchants to read the card’s information. This can result in transactions being declined or errors in processing payments, which could lead to unauthorized charges or payment delays.

If the card number is exposed due to a split or other form of damage, it could potentially be used in combination with other information to commit fraud.

For example, a fraudster could potentially use social engineering tactics to obtain the cardholder’s PIN or other personal information and use this information to make unauthorized transactions on the cardholder’s account.

Therefore, it’s important to handle a split card with care and to contact your bank immediately to report the damage and request a replacement. Additionally, monitor your account activity regularly for any unauthorized transactions and report any suspicious activity to your bank immediately.

While it may be tempting to use tape to repair a broken debit card, it is not recommended. Using tape to fix a broken card could potentially make the card difficult or impossible to use, and it may also compromise the security of the cardholder’s personal information.

How to Handle a Debit Card with a Cracked Chip

If your debit card has a cracked chip, it’s important to contact your bank immediately to report the damage and request a replacement. A cracked chip can make it difficult or impossible to use the card, and it may also compromise the security of the cardholder’s personal information.

Your bank will advise you on the next steps to take, which may include visiting a branch to get a new card or having one sent to you by mail. In the meantime, you can consider alternative payment methods such as online banking or mobile wallets to access your funds.

Cost of Replacing a Damaged Debit Card

If the card was damaged due to negligence or intentional misuse, the bank may charge a fee for the replacement. The fee can vary depending on the bank and the card type being replaced, but it is typically in the range of $5 to $10.

The cost of replacing a damaged debit card can vary depending on the bank and the circumstances surrounding the damage.

How Long to Replace a Damaged Debit Card?

The time it takes to replace a damaged debit card can vary depending on the bank and the circumstances surrounding the damage.

In some cases, banks may be able to issue a new card on the spot at a branch location or may offer expedited shipping for a replacement card sent by mail. However, in other cases, it may take several days to receive a replacement card in the mail.

The exact timeline can depend on factors such as the bank’s policies, the availability of replacement cards, and the delivery method used.

FAQs

Do banks replace cards for free?

Some banks may offer free card replacements, while others may charge a fee. In general, banks may be more likely to waive the replacement fee if the card was damaged due to normal wear and tear or if it was compromised due to fraudulent activity.

Does replacing a card change the card number?

Replacing a card doesn’t necessarily change the card number. Some banks may issue a replacement card with the same number, while others may issue a new card with a different number.

Can a bent debit card still be used at an ATM?

If the card is only slightly bent, it may still work, but if the bend is more severe, the ATM may not accept the card. But even if an ATM accepts it, continued use of the damaged card can cause further bending or warping, which may eventually make the card unusable.

Therefore, it’s best to request a replacement card from your bank as soon as possible to avoid potential issues with card acceptance or functionality.