Note: Some links may earn us a commission at no cost to you. Learn more in our privacy policy.

Best virtual card provider: Divvy (now Bill)

Virtual cards are becoming increasingly popular among businesses, and according to Forbes, they could eventually become universal.

So, what makes virtual debit/credit cards so appealing? For starters, they’re practically impossible to steal and act as a buffer between your real card and funding source, providing an extra layer of security.

Additionally, you can control spending and reduce costs by using virtual credit card providers. These cards are also very convenient and easy to use, as they can be generated with just a few clicks.

Virtual credit/debit cards work the same way as physical cards, but they only exist online. Virtual card providers will generate a virtual payment card for you through a website or mobile app that you can use for online payments almost anywhere. Many providers offer these cards for free.

I’ve reviewed and examined all virtual cards and providers in this list. These are the best ones available in the US.

What are the best virtual debit/credit cards?

Here are my top picks for the best virtual debit/credit cards to use this year:

- Divvy (now Bill).

- Revolut.

- Payoneer.

- Extend.

- Stripe.

- Penny.

- Privacy.

- Citi.

- Capital One.

- Emburse.

- US Unlocked.

- Venmo.

- American Express Go.

- Netspend.

- Bento.

- Brex.

- Airtm.

It’s worth mentioning that all of these cards have their own features and benefits, and you can pick the one that suits your needs.

1. Divvy (now Bill)

Best virtual credit card provider (plus #1 expense management platform)

Divvy is the ultimate solution for businesses looking to take control of their spending and reduce costs. With Divvy, you can instantly create free virtual credit cards for every merchant you buy from, and unique VCCs (virtual credit cards) for every recurring payment you need to pay. This makes it easy to keep track of your expenses, set spending limits and manage your business finances in one place.

One of the key benefits of Divvy is its flexibility. With the ability to create an unlimited number of virtual credit cards, you can customize your cards for different merchants, projects, and expenses. This allows you to set spending limits, track expenses and monitor your budget in real-time. With Divvy you can also create recurring payments, so you don’t have to worry about missing a payment or exceeding your budget.

Divvy integrates with a lot of business tools, such as accounting software and invoicing platforms. It is the perfect solution for businesses looking to take control of their spending and reduce costs.

Highlights:

- Unlimited number of virtual credit cards

- Create virtual cards for single or multi-payments

- Set maximum spend, expiration date, and merchant lock

- integration with business tools like Slack, Xero, QuickBooks

- Send payments and set limits against a budget.

- earn 1-7x rewards with a scalable credit line

- Pricing: free trial option and pricing starts at $99 per month

The security features of Divvy include multi-factor authentication and encryption. Divvy offers 24/7 customer support and has an extensive FAQ section on its website.

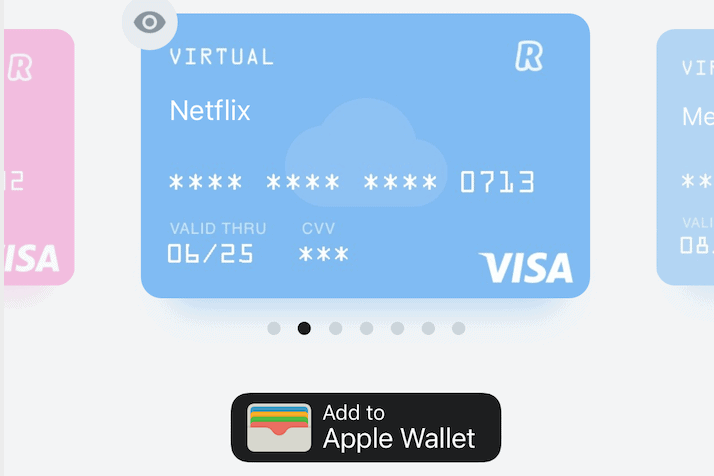

2. Revolut

Best virtual prepaid debit card provider (and more)

Revolut offers instant virtual prepaid debit cards from their app, with great perks and benefits for everyone. They now offer their services in the US through their virtual prepaid debit card, providing great exchange rates without hidden fees. Revolut offers services next to virtual cards, including budgeting and analytics. They have personal and business options with three types of plans in the US: Standard ($0/month), Premium ($9.99/month), and Metal ($16.99/month).

20M+ customers use Revolut cards and services worldwide for all kinds of domestic and international payments, and they provide perks and benefits not available at most other providers. Sign up and get Revolut Premium subscription-free for 3 months through this link.

Highlights:

- single-use virtual cards (for privacy and security) or subscription cards (for longevity)

- International money transfers with 10 zero-fee international transfers per month

- spend in 25+ currencies at the market exchange rate

- no hidden fees with unlimited P2P transfers within the Revolut network

- cash-back and travel perks

- Revolut<18 account for kids and teens available

- Revolut pricing plans: $0/month, $9.99/month, and $16.99/month

Please note that Revolut is frequently updating its products and features, see the Revolut Terms and Conditions for the latest offerings. Revolut is a financial technology company. Banking services provided by Metropolitan Commercial Bank (Member FDIC).

The Revolut USA Prepaid Visa Card is issued by Metropolitan Commercial Bank pursuant to a license from Visa U.S.A. Inc. International and may be used everywhere Visa is accepted. Banking services are provided by Metropolitan Commercial Bank, Member FDIC. Revolut Technologies Inc. is a technology services provider and administrator of the card program.

3. Payoneer

The biggest physical and virtual card provider

If you’re looking for a convenient and secure way to make online payments, look no further than Payoneer’s Virtual Mastercard. With Payoneer, you can easily make payments online, in any currency, anywhere Mastercard is accepted. This makes it the perfect solution for businesses and individuals who frequently make online payments.

One of the key benefits of Payoneer’s Virtual Mastercard is its universal acceptance. Mastercard is accepted at millions of merchants worldwide, giving you the freedom to make payments wherever you need to. This makes it an ideal choice for businesses that operate globally, or for individuals who frequently travel.

In summary, Payoneer’s Virtual Mastercard is an all-in-one solution for convenient, secure and cost-effective online payments. Sign up today and experience the benefits for yourself! Get $25 by signing up with Payoneer through this link.

Highlights:

- pay online anywhere where Mastercard is accepted

- pay for marketing campaigns (such as purchasing ads on social media) on Facebook and Google

- multiple virtual cards for use across platforms and storefronts

- security features include multi-factor authentication and encryption

- pay to contractors, suppliers, and all other business expenses

- Payoneer account fees are $29.95 annually.

4. Extend

Are you tired of using your physical credit card for every transaction? Introduce yourself to Extend – the revolutionary platform that allows you to create virtual cards with your existing credit card. Whether you’re a business owner, freelancer, or simply someone who wants an added layer of security, Extend is the perfect solution for you.

And the best part? It’s available for anyone with a credit card with partner banks such as American Express, City National Bank, Pacific Western Bank, Bank of the West, Silicon Valley Bank, Regions Bank, and Comdata. Upgrade your credit card game with Extend today!

Highlights:

- Create virtual cards without any limits

- Choose from one-time, recurring, and auto-refill options for your virtual cards

- Create virtual cards in bulk, up to 100 at a time

- Easily distribute virtual cards to anyone with an email address

- Send virtual cards to vendors, employees, contractors, and other recipients

- Organize different projects, clients, or spend categories by delegating cards and budgets

- Keep track of all your business credit card rewards in one place

- Use Extend at no cost, without any fees for creating, sending, and managing virtual cards.

5. Stripe

Stripe is the go-to platform for businesses looking for a reliable and efficient way to handle payments to clients and employees. With Stripe, you can create as many instant virtual cards as you need, as well as the option to order physical cards. This feature is especially beneficial for businesses that need to make multiple payments regularly.

But Stripe is not just a virtual card issuer. It’s a complete payment solution provider. Stripe offers various financial services, including management, automation, and payment solutions. This makes it an ideal choice for businesses of all sizes, whether you’re a small start-up or a large corporation.

Stripe’s user-friendly interface, easy integration with existing systems, and top-notch security features make it an increasingly popular choice in the virtual card world. Plus, Stripe offers detailed analytics and reporting, which enables businesses to gain insight into their payment patterns and make more informed decisions.

Highlights:

- Detailed analytics and reporting: gain insight into your payment patterns and make more informed decisions.

- easy and fast setup with an instant generation of cards

- Accept payments from multiple channels such as online, mobile, and in-store payments, and in multiple currencies.

- limit business types and industry

- Offers fraud prevention, chargeback management, and local and international regulations compliance.

- User-friendly interface and easy integration with existing systems.

- Top-notch security features

- Stripe offers customized Pricing

6. Penny

Introducing Penny, the innovative platform that empowers you to issue unlimited virtual prepaid cards – and all for free. With Penny, you can manage everything from petty cash to ad spend, fuel, and travel expenses to disposable gift cards. Penny has something to offer everyone, whether you’re a business owner, a manager, or an individual.

Penny offers a powerful expense management tool and reporting and analytics tools to gain insights into your spending habits and make more informed decisions.

Highlights:

- Unlimited number of free new virtual cards

- Free single-use prepaid debit or credit Mastercards

- Expense management tools: track and control your expenses, set budgets and limits, and delegate permissions and access to different staff members.

- Control spending limit against a budget or cardholders

- Streamline your expenses, reduce the risk of fraud, and improve the overall efficiency of your financial operations.

- Pricing: $0 with no hidden fees and no lock-in contracts. Penny doesn’t charge any fees or service charges

7. Privacy

Privacy.com offers a revolutionary solution for residents of the United States who value privacy and security when it comes to their finances. With Privacy.com, you can instantly create free virtual debit and credit cards, giving you the flexibility and convenience to make online purchases, subscriptions, and payments with ease.

As the name suggests, Privacy.com values your privacy and has taken extensive measures to protect your sensitive information. With their virtual debit and credit cards, you can make online transactions without having to share your personal information with merchants. This means you can shop online with peace of mind, knowing that your information is safe and secure.

Another advantage of Privacy.com is the ability to create multiple virtual cards for different merchants, subscriptions, and expenses. This allows you to easily keep track of your spending, set budgets, and monitor your finances in real-time.

Highlights:

- free virtual cards if you use a bank account as a funding source

- Chrome/Firefox extension to instantly change who can charge your card, how much, how often, and to close the card

- set max charge limits on each card, or lock to a merchant

- your personal information is 100% private at all times

- Pricing – three tiers: Personal (free), Pro ($10 a month), and Teams ($25 a month)

8. Citi

Citi is the 3rd largest banking institution in the US and one of the largest banks with virtual cards, but they are not available for all Citi cards. You can generate Citi’s virtual card by using Citi’s Virtual Account Numbers. Their Virtual Card Accounts offer tremendous flexibility for businesses and consumers alike.

Highlights:

- Limit number of uses for each card

- Set a maximum limit or range for spending

- Limit card use to a few hours or up to two years

- Lock to a single supplier/vendor or a category of suppliers

- Businesses benefit through improved audit capabilities delivering directly to ERP systems to automate reconciliation

- Can be used for local-currency payments in 40+ countries and nearly 30 unique currencies

- Fees depend on the type of card you use to generate your Virtual card with

9. Capital One

One of the most popular banks with virtual credit cards, Capital one, offers their virtual cards through their Eno service. With this, Capital One can generate free virtual credit card numbers for you if you have a Capital One credit card. Their virtual cards get integrated with your Capital One credit card account, and to do that, you need to install their Eno Chrome extension first.

Highlights:

- every virtual card number unique to each vendor

- lock, unlock, or delete your virtual card numbers for any vendor

- Eno Chrome Extension offers various benefits such as generating a virtual card number at checkout

- earn the benefits and rewards since it’s linked to your account

- Adds another layer of protection to your credit card account

10. Emburse

Emburse offers instant virtual debit/credit cards through their cloud-based solution. They offer the same security advantages as other virtual card providers, plus a decent number of additional expenses and purchasing automation solutions.

Highlights:

- set budget, time, and category restrictions

- assign each virtual card to a different merchant

- Apple Wallet and Android Pay ready

- transfer funds instantly

- assign virtual cards to remote employees or contractors

- create an unlimited number of virtual cards

11. Us Unlocked

The US Unlocked provides a virtual Visa debit card and prepaid virtual cards that you can use with almost all major online merchants. Their main offer is giving you access to US brands, plus they work with some of the top freight forwarders in the world.

Highlights:

- Order products and services attached to your billing address

- Offers locking to a single merchant with Merchant Specific Payment Card

- Generate an instant free new virtual card number after every online purchase

- Fees: $15 when signing up, plus a monthly fee of $3.5, plus top-up charge, load, and transaction fees.

12. Venmo

Venmo offers a virtual credit card for online purchases, next to ordering their physical credit card. Using their digital wallet, you can split your credit card purchases with friends.

Highlights:

- use the virtual card while you wait for physical

- one virtual card at any time

- Pay in apps, online or local

- Must confirm SSN to view the virtual card number

- Samsung Pay, Google Pay, Apple Pay ready

13. American Express Go

American Express offers virtual cards through their Amex Go mobile app. If you are a business owner, you can create Amex Go virtual cards for your employees to control spending and simplify reconciliation.

Highlights:

- Can be used anywhere American Express is accepted, including outside the U.S.

- Use online immediately or add to a mobile wallet for on-the-go use

- Keep track of transactions from all users with one consolidated bill

- Virtual card is reusable

- Fees: a one-time fee of $2 per user profile for virtual-only purchases

14. Netspend

Netspend offers multiple free prepaid virtual card numbers, which you can link to your already existing prepaid card.

Highlights:

- Generate up to 6 free virtual debit cards

- Must link prepaid card to a virtual card

- Must verify identity to be approved

- Can be used internationally

- Fees vary. They offer a monthly plan and pay-as-you-go plan for flexibility. You can check the details here.

15. Bento

Bento offers instant virtual debit cards through their business spending management platform. Bento specifically targets businesses, and you can try it free for 60 days.

Highlights:

- Set a spending limit for your virtual debit card

- single purchase or recurring purchases

- Restrict merchant categories, international or other transactions

- For business owners more security, speed and scalability

- Bento virtual debit card fees are already covered by the monthly pricing plan (first 2 months free)

16. Brex

Brex offers full financial software that gives access to your virtual corporate credit card once you’ve been approved. Brex recommends their virtual cards for businesses, to issue virtual cards to your team members.

Highlights:

- Control spending by setting card-specific limits

- Track expenses, earn rewards

- Earn points on all card spend

- need corporate Card before getting virtual cards

- Fees:

- no annual fee,

- no foreign transaction fees,

- no interest charges

- Brex Premium account is $49/month.

17. Airtm

Airtm offers a way to get your own virtual debit card in USD and send any local currency for any other local currency, using USD as the base value. They act as escrow and work with Steam, Netflix, Spotify, Paypal, Venmo, Bitcoin, and many other options of payment.

Highlights:

- Make online purchases in any currency

- Send and receive money

- Some people use it for bitcoin and other cryptocurrency payments: you can buy crypto, change crypto to USD, and USD to any local currency

- No local restrictions

- No minimum balances or monthly fees

FAQs

What are the benefits of virtual debit/credit cards?

Virtual cards can be a good idea for many people, offering several benefits. They can provide added security by acting as a buffer between your funding source and merchant, preventing fraud and allowing anonymous payments via throwaway numbers. They also offer convenience and control over spending and can help businesses save processing costs and improve internal controls.

You can save time with virtual cards and use your digital cards and digital wallets everywhere. Any vendor or business that accepts payments by a debit or credit card generally accepts virtual cards.

When selecting the best virtual debit card, it’s essential to consider not just the card’s features but also its compatibility with your regular online merchants and the level of customer service the provider offers.

What are the disadvantages of virtual cards?

Virtual cards have potential disadvantages, such as limited acceptance, fees, functionality, and online transactions. Not all banks issue them, and if you lose the physical card, you may need to cancel the virtual card. Evaluating these potential disadvantages and weighing them against the benefits is important before deciding if a virtual card is a right choice.

Can a virtual card be stolen?

A virtual card can theoretically be stolen if someone gains access to your virtual card number, expiration date, and security code. However, it is less likely to be stolen than a physical card, as it is often a one-time use number and doesn’t have a physical form.

Additionally, virtual card providers usually have security measures in place, such as multi-factor authentication and encryption, as well as the ability to cancel or freeze a card if it is lost or stolen.

Are virtual cards illegal?

Virtual cards are not illegal. They are a legitimate and secure form of payment that many merchants and online platforms accept. They are issued by banks and fintech companies and are protected by the same laws and regulations as physical cards. The same fraud prevention measures and consumer protection laws also protect them.

Which US banks have virtual cards?

Many US banks now offer virtual cards to their customers. Some examples include Citi bank, Capital One, American Express, US Bank, Wells Fargo, Chase, Bank of America, Discover, PNC bank, TD bank, BB&T bank, BMO Harris bank, USAA, Fidelity Bank, Ally bank, Huntington bank, SunTrust bank, Regions bank.

Do virtual cards have a CVV number?

Yes, virtual cards typically have a CVV (Card Verification Value) number. The CVV number is a security feature used to verify that the person making the purchase has the physical card in their possession. The CVV number is a 3-digit or 4-digit number usually found on the back of the physical card, but it can also be found on the virtual card.