Note: Some links may earn us a commission at no cost to you. Learn more in our privacy policy.

Managing your finances is a breeze with a debit card, but what happens when you activate a new one?

When you activate a new debit card, the old one generally becomes deactivated and stops working for transactions, ensuring security and protecting your account from unauthorized access.

Continue reading to learn more about the activation process and its implications, and how to ensure a smooth transition to your new card.

Does Getting a New Debit Card Deactivate the Old One?

When you receive and activate a new debit card, the old one typically becomes deactivated. This is done as a security measure to prevent unauthorized access to your account and protect against fraud.

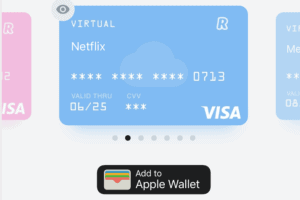

The new card will have a different number, expiration date, and security code, requiring activation before you can use it for transactions.

It’s important to note that the deactivation process may vary depending on your bank or credit union. In most cases, the old card is deactivated immediately upon activating the new one.

However, some financial institutions may have a short grace period where the old card remains active for a limited time. It’s best to check with your bank for their policies regarding card deactivation to avoid any potential issues.

Can You Use Both Old and New Debit Cards Simultaneously?

In general, you cannot use both old and new debit cards simultaneously.

Once you activate your new debit card, the old one is usually deactivated by your bank or credit union as a security measure. This ensures your account remains protected from unauthorized access and fraudulent activities. The old card basically stops working, both online and in shops.

It’s always a good idea to double-check your financial institution’s specific policies on card activation and deactivation, but the standard practice is to have only one active card at a time.

What Is the Purpose of Activating a Debit Card?

The purpose of activating a debit card is to verify your identity and confirm that the card has been received by the intended recipient.

Activation serves as a security measure to help prevent unauthorized access and fraudulent activities. During the activation process, you may be asked to provide personal information, such as your card number, expiration date, security code, or account details.

This ensures that only the authorized cardholder can begin using the card for transactions.

In addition, activation allows the bank or credit union to update their systems, linking the new card to your account and deactivating the old one, further enhancing the security of your account.

What to Do With an Old Debit Card Once You Activate the New One?

After activating your new debit card and ensuring the old one has been deactivated, it’s essential to dispose of it securely to prevent unauthorized use or identity theft. Cut the old card into small pieces, making sure to slice through the magnetic stripe, chip, and any raised numbers.

You can also consider using a card shredder for added security. Don’t forget to dispose of the pieces in different trash bags to further reduce the chances of misuse.

Will Recurring Payments Be Affected by a New Debit Card?

Yes, recurring payments can be affected by a new debit card. Since your new card will have a different number, expiration date, and security code, any automatic payments linked to the old card may fail to process.

Updating your card information with merchants and service providers is important to avoid missed payments, late fees, or service disruptions.

How to Update Your Card Information for Recurring Payments?

To update your card information for recurring payments, follow these steps:

- Make a list. Identify all merchants and service providers with whom you have set up recurring payments, including subscriptions, utilities, loans, and memberships.

- Access your accounts. Log in to your online accounts for each provider, or contact them directly if you don’t have online access.

- Locate payment settings. Find the payment settings or billing section of your account, where your card information is stored.

- Update card details. Replace your old card information with the new debit card number, expiration date, and security code. Save the changes.

- Confirm changes. Check for any confirmation emails or notifications to ensure the updates have been processed successfully.

- Monitor your accounts. Keep an eye on your bank statement and provider accounts to ensure the recurring payments go through without issues.

Will Direct Deposits Be Impacted by a New Debit Card?

No, direct deposits should not be impacted by a new debit card. Direct deposits are linked to your bank account, not your debit card.

As long as your account and routing numbers remain unchanged, your direct deposits will continue processing as usual.

However, if you have also changed your bank account, make sure to provide your new account and routing numbers to your employer or any other organizations responsible for your direct deposits.

FAQs

How can you tell if your debit card is activated?

You can tell if your debit card is activated by attempting a small purchase or balance inquiry at an ATM. If the transaction is successful, your card is activated. Alternatively, you can contact your bank or credit union’s customer service, or read our guide on how to check if your card is working.

Will activating a new debit card affect your account balance?

No, activating a new debit card will not affect your account balance. The new card is simply a replacement for the old one and remains linked to the same account.

Will activating a new debit card affect your credit score?

Activating a new debit card does not affect your credit score. Debit cards are linked to your checking account and do not involve borrowing money or reporting to credit bureaus.

Your credit score is mainly influenced by factors related to credit usage, such as credit card balances, payment history, and credit utilization.